New Ideas For Picking Automated Trading Macryt

What Are Backtesting Trading Strategies To Trade Cryptocurrency Currencies?

Backtesting trading methods in the field of crypto trading is the process of simulating the execution of a strategy using historical data to establish whether it will be profitable. Here are a few steps to backtest your crypto trading strategies. Historical data: Find historical data on the crypto asset being trade with, including prices and volumes.

Trading Strategy - Define the trading strategy being used with regard to entry and withdrawal rules, position sizing and risk management regulations.

Simulator: This software simulates the execution of a trading strategy based on historical data. This lets you see how the strategy did over time.

Metrics: Measure the effectiveness of the strategy with metrics like profitability, Sharpe, drawdown, and any other pertinent measures.

Optimization: Modify the parameters of the strategy to improve the strategy's performance.

Validation: Test the effectiveness of the strategy on samples of data in order to verify its robustness and prevent overfitting.

It is essential to keep in mind that past performance isn't indicative of future results Results from backtesting are not to be regarded as a guarantee of future profits. Also, live trading requires to consider market volatility, transaction costs as well as other issues that are real-world. View the top forex backtesting blog for site info including best expert advisor for forex trading, 3commas pricing, free stock trading chat rooms, top trading chat rooms, short term crypto trading, coinrule bot, auto stock trading apps, instant cryptocurrency exchange, webull cryptocurrency, trader cfd forum, and more.

What Can You Do To Assess The Forex Backtest Program When Trading With Diversgence?

When evaluating software for backtesting forex in order to trade with RSI Divergence, these factors must be taken into consideration. Data Accuracy: Make sure that the program has access to and is able to use historical information from the pairs of forex being traded.

Flexibility The flexibility of RSI divergence strategies for trading are able to be adapted and tested by the software.

Metrics : The program should contain a variety of metrics to evaluate the performance of RSI Divergence Strategies for Trading, including profitability, drawdown and risk/reward rate.

Speed: Software should be fast and efficient in order to enable rapid backtesting of multiple strategies.

User-Friendliness. Even for those who do not have a lot of expertise in technical analysis it is essential that the program be simple to use.

Cost: Consider the price of the software and decide if you can afford it.

Support: The software should provide exceptional customer support that includes tutorials, technical support as well as other assistance.

Integration: The program must integrate with other tools to trade, like charting software, or trading platforms.

Before you sign up for a subscription, it's important to check out the software before purchasing it. See the top rated see for more info including robot system forex, trading discussion forum, fibonacci crypto, ticker message board, etrade cryptocurrency, automated trading on binance, best app for trading crypto, cryptocurrency futures trading, algo trading using amibroker, tradingview auto buy sell, and more.

What Are The Most Important Elements That Affect Rsi Divergence?

Definition: RSI Divergence refers to an analytical tool used to analyze technical data that compares an asset’s price movement with its relative strength indicator (RSI). Types of RSI Divergence

Regular Divergence - If the price of an asset's market is at an upper or lower level than its low, yet the RSI is at a lower high or lower lowest level, it's called regular divergence. It could indicate a potential trend reversal, however it is important to keep in mind other technical or fundamental factors.

Hidden Divergence - This happens when the asset's price hits the lower end of the range or lower low, while the RSI is higher at the high and lower low. While this is less than regular divergence it can nevertheless be a sign of a possible trend reversal.

Take note of these technical aspects:

Trend lines and support/resistance levels

Volume levels

Moving averages

Other indicators and oscillators

Consider these fundamental factors:

Data releases on economic issues

Information specific to businesses

Market sentiment and indicators of sentiment

Global events and their effects on the market

It's important to take a look at both technical and fundamental factors prior to making investment decisions based upon RSI divergence indicators.

Signal A positive RSI signal is thought to be a bullish sign, while any negative RSI deviation is thought to be bearish.

Trend Reversal - RSI diversification is an indication of a possible trend reverse.

Confirmation RSI divergence can be used to confirm other methods of analysis.

Timeframe: RSI Divergence can be observed in different timeframes to get different insight.

Overbought or Oversold RSI Values above 70 indicate excessively high conditions. Values below 30 indicate that there are oversold conditions.

Interpretation: To interpret RSI divergence correctly involves taking into consideration the other fundamental and technical factors. See the best here are the findings for online trading platform for more examples including short trading crypto, 3commas smart trade, selling crypto on robinhood, automated trading signals, primexbt welcome bonus, automated trading mt5, gorilla trades reddit, best app for trading cryptocurrency, exness forexpeacearmy, robotic trading platform, and more.

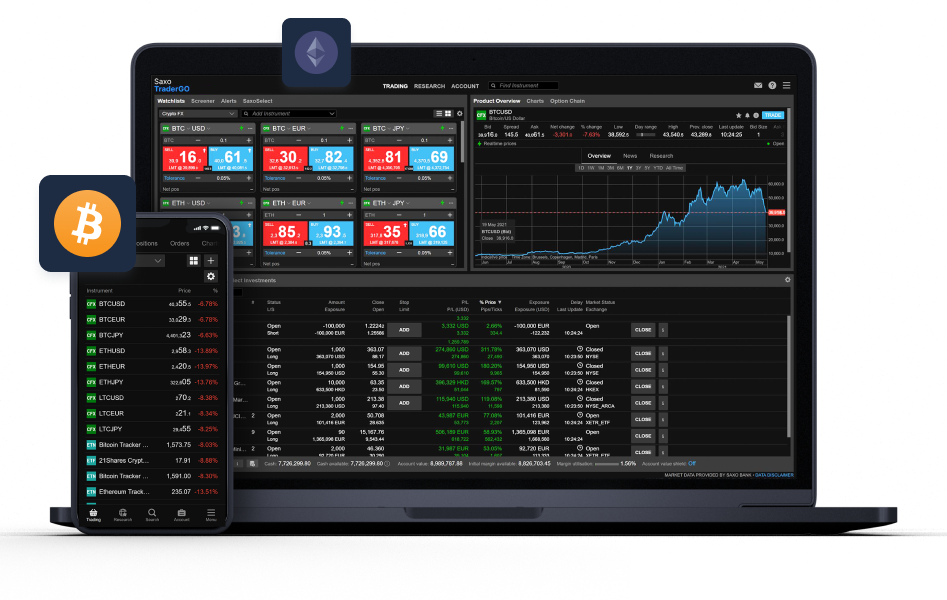

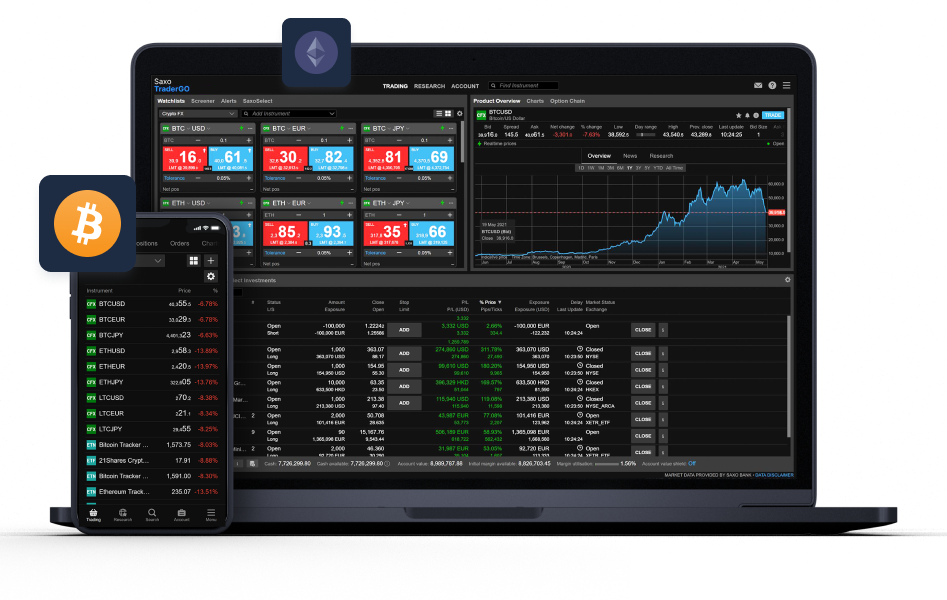

What Are The Top Cryptocurrency Trading Platforms That Can Automatize The Trading Of Crypto?

There are numerous cryptocurrency trading platforms that allow automated crypto trading each one with its own unique features and capabilities. 3Commas, a web-based platform which lets traders design and run automated trading robots on multiple cryptocurrency markets, is one of the most well-known. It supports a variety of trading strategies such as both long and short positions. It also allows users backtest their bots by using historical data.

Cryptohopper: Cryptohopper enables traders to design and implement trading platforms for multiple cryptocurrencies across several exchanges. It offers a range of pre-built trading strategies, and an editor that can be used to create custom strategies.

HaasOnline: HaasOnline allows traders to build and run automated trade bots for multiple currencies on various exchanges. It comes with a variety of advanced features, such as market making, backtesting and arbitrage trading.

Gunbot: Gunbot, a download-able software permits traders to design trading bots that can be used for multiple currencies on various exchanges. Gunbot offers a variety of pre-designed strategies, and also allows you to create customized strategies using a visual editor.

Quadency: Quadency allows traders to build and execute automated trading robots for multiple cryptocurrency exchanges. It offers a range of trading strategies, as well as portfolio management tools and backtesting capabilities.

Take into consideration factors such as the number of trading and exchange strategies, as well the ease of use as well as cost and price when choosing a cryptocurrency trading platform. Before you can begin trading, it's important to test the trading bot by using a demo account and an amount of real money. Have a look at the top rated https://blog.cleo.finance/trade-rsi-divergence-automatically/ for website info including binance crypto exchange, best forum for stock market, futures trading on binance, stock trading forums reddit, free stock trading chat rooms, coinbase stock crypto, best trading crypto platform, cryptocurrency investment app, auto buy sell trading software, crypto buy and sell, and more.

What Are The Main Differences Between Cryptocurrency Trading Sites?

There are many distinctions among online cryptocurrency trading platforms. Security: The most significant difference between them is the level of security. Some platforms may have more robust security measures implemented, like two-factor authentication as well as cold storage of funds but others could have weaker security measures that expose them to theft and hacking.

User Interface: The interface for cryptocurrency trading platforms can vary from simple and straightforward to more complicated and difficult to navigate. Certain platforms could provide more sophisticated trading tools and features, whereas others are geared towards beginner traders.

Trading Fees. Another important distinction between cryptocurrency trading platforms. Although some platforms have higher fees for trading, other platforms offer lower fees for a limited trading selection or more sophisticated trading capabilities.

Different platforms support different cryptocurrencies and this can impact the options available to traders. Although some platforms provide greater trading pairs than others others might only be able to accept the most well-known cryptocurrencies.

Regulation: The degree of regulation and oversight can vary widely between cryptocurrency trading platforms. While certain platforms are more tightly regulated than others, other platforms operate without much oversight.

Customer Support: The amount and quality of customer service will also differ between trading platforms. Some platforms provide 24/7 support via live chat or phone and others provide email support, and only for a limited time.

Summary: There are a variety of variations between cryptocurrency trading platforms. They differ in security as well as user interfaces and costs. The supported cryptocurrency can also be traded. Regulations may also be different. These aspects could impact the experience of trading and also on the risk. Check out the most popular web site about position sizing calculator for more examples including best canadian crypto exchange, best stock trading forums, binance auto buy sell, strategy alerts tradingview, 3commas smart trade, blockfi trading, interactive brokers auto trading, swing trading forum, phemex exchange, penny stock trading chat rooms, and more.

Backtesting trading methods in the field of crypto trading is the process of simulating the execution of a strategy using historical data to establish whether it will be profitable. Here are a few steps to backtest your crypto trading strategies. Historical data: Find historical data on the crypto asset being trade with, including prices and volumes.

Trading Strategy - Define the trading strategy being used with regard to entry and withdrawal rules, position sizing and risk management regulations.

Simulator: This software simulates the execution of a trading strategy based on historical data. This lets you see how the strategy did over time.

Metrics: Measure the effectiveness of the strategy with metrics like profitability, Sharpe, drawdown, and any other pertinent measures.

Optimization: Modify the parameters of the strategy to improve the strategy's performance.

Validation: Test the effectiveness of the strategy on samples of data in order to verify its robustness and prevent overfitting.

It is essential to keep in mind that past performance isn't indicative of future results Results from backtesting are not to be regarded as a guarantee of future profits. Also, live trading requires to consider market volatility, transaction costs as well as other issues that are real-world. View the top forex backtesting blog for site info including best expert advisor for forex trading, 3commas pricing, free stock trading chat rooms, top trading chat rooms, short term crypto trading, coinrule bot, auto stock trading apps, instant cryptocurrency exchange, webull cryptocurrency, trader cfd forum, and more.

What Can You Do To Assess The Forex Backtest Program When Trading With Diversgence?

When evaluating software for backtesting forex in order to trade with RSI Divergence, these factors must be taken into consideration. Data Accuracy: Make sure that the program has access to and is able to use historical information from the pairs of forex being traded.

Flexibility The flexibility of RSI divergence strategies for trading are able to be adapted and tested by the software.

Metrics : The program should contain a variety of metrics to evaluate the performance of RSI Divergence Strategies for Trading, including profitability, drawdown and risk/reward rate.

Speed: Software should be fast and efficient in order to enable rapid backtesting of multiple strategies.

User-Friendliness. Even for those who do not have a lot of expertise in technical analysis it is essential that the program be simple to use.

Cost: Consider the price of the software and decide if you can afford it.

Support: The software should provide exceptional customer support that includes tutorials, technical support as well as other assistance.

Integration: The program must integrate with other tools to trade, like charting software, or trading platforms.

Before you sign up for a subscription, it's important to check out the software before purchasing it. See the top rated see for more info including robot system forex, trading discussion forum, fibonacci crypto, ticker message board, etrade cryptocurrency, automated trading on binance, best app for trading crypto, cryptocurrency futures trading, algo trading using amibroker, tradingview auto buy sell, and more.

What Are The Most Important Elements That Affect Rsi Divergence?

Definition: RSI Divergence refers to an analytical tool used to analyze technical data that compares an asset’s price movement with its relative strength indicator (RSI). Types of RSI Divergence

Regular Divergence - If the price of an asset's market is at an upper or lower level than its low, yet the RSI is at a lower high or lower lowest level, it's called regular divergence. It could indicate a potential trend reversal, however it is important to keep in mind other technical or fundamental factors.

Hidden Divergence - This happens when the asset's price hits the lower end of the range or lower low, while the RSI is higher at the high and lower low. While this is less than regular divergence it can nevertheless be a sign of a possible trend reversal.

Take note of these technical aspects:

Trend lines and support/resistance levels

Volume levels

Moving averages

Other indicators and oscillators

Consider these fundamental factors:

Data releases on economic issues

Information specific to businesses

Market sentiment and indicators of sentiment

Global events and their effects on the market

It's important to take a look at both technical and fundamental factors prior to making investment decisions based upon RSI divergence indicators.

Signal A positive RSI signal is thought to be a bullish sign, while any negative RSI deviation is thought to be bearish.

Trend Reversal - RSI diversification is an indication of a possible trend reverse.

Confirmation RSI divergence can be used to confirm other methods of analysis.

Timeframe: RSI Divergence can be observed in different timeframes to get different insight.

Overbought or Oversold RSI Values above 70 indicate excessively high conditions. Values below 30 indicate that there are oversold conditions.

Interpretation: To interpret RSI divergence correctly involves taking into consideration the other fundamental and technical factors. See the best here are the findings for online trading platform for more examples including short trading crypto, 3commas smart trade, selling crypto on robinhood, automated trading signals, primexbt welcome bonus, automated trading mt5, gorilla trades reddit, best app for trading cryptocurrency, exness forexpeacearmy, robotic trading platform, and more.

What Are The Top Cryptocurrency Trading Platforms That Can Automatize The Trading Of Crypto?

There are numerous cryptocurrency trading platforms that allow automated crypto trading each one with its own unique features and capabilities. 3Commas, a web-based platform which lets traders design and run automated trading robots on multiple cryptocurrency markets, is one of the most well-known. It supports a variety of trading strategies such as both long and short positions. It also allows users backtest their bots by using historical data.

Cryptohopper: Cryptohopper enables traders to design and implement trading platforms for multiple cryptocurrencies across several exchanges. It offers a range of pre-built trading strategies, and an editor that can be used to create custom strategies.

HaasOnline: HaasOnline allows traders to build and run automated trade bots for multiple currencies on various exchanges. It comes with a variety of advanced features, such as market making, backtesting and arbitrage trading.

Gunbot: Gunbot, a download-able software permits traders to design trading bots that can be used for multiple currencies on various exchanges. Gunbot offers a variety of pre-designed strategies, and also allows you to create customized strategies using a visual editor.

Quadency: Quadency allows traders to build and execute automated trading robots for multiple cryptocurrency exchanges. It offers a range of trading strategies, as well as portfolio management tools and backtesting capabilities.

Take into consideration factors such as the number of trading and exchange strategies, as well the ease of use as well as cost and price when choosing a cryptocurrency trading platform. Before you can begin trading, it's important to test the trading bot by using a demo account and an amount of real money. Have a look at the top rated https://blog.cleo.finance/trade-rsi-divergence-automatically/ for website info including binance crypto exchange, best forum for stock market, futures trading on binance, stock trading forums reddit, free stock trading chat rooms, coinbase stock crypto, best trading crypto platform, cryptocurrency investment app, auto buy sell trading software, crypto buy and sell, and more.

What Are The Main Differences Between Cryptocurrency Trading Sites?

There are many distinctions among online cryptocurrency trading platforms. Security: The most significant difference between them is the level of security. Some platforms may have more robust security measures implemented, like two-factor authentication as well as cold storage of funds but others could have weaker security measures that expose them to theft and hacking.

User Interface: The interface for cryptocurrency trading platforms can vary from simple and straightforward to more complicated and difficult to navigate. Certain platforms could provide more sophisticated trading tools and features, whereas others are geared towards beginner traders.

Trading Fees. Another important distinction between cryptocurrency trading platforms. Although some platforms have higher fees for trading, other platforms offer lower fees for a limited trading selection or more sophisticated trading capabilities.

Different platforms support different cryptocurrencies and this can impact the options available to traders. Although some platforms provide greater trading pairs than others others might only be able to accept the most well-known cryptocurrencies.

Regulation: The degree of regulation and oversight can vary widely between cryptocurrency trading platforms. While certain platforms are more tightly regulated than others, other platforms operate without much oversight.

Customer Support: The amount and quality of customer service will also differ between trading platforms. Some platforms provide 24/7 support via live chat or phone and others provide email support, and only for a limited time.

Summary: There are a variety of variations between cryptocurrency trading platforms. They differ in security as well as user interfaces and costs. The supported cryptocurrency can also be traded. Regulations may also be different. These aspects could impact the experience of trading and also on the risk. Check out the most popular web site about position sizing calculator for more examples including best canadian crypto exchange, best stock trading forums, binance auto buy sell, strategy alerts tradingview, 3commas smart trade, blockfi trading, interactive brokers auto trading, swing trading forum, phemex exchange, penny stock trading chat rooms, and more.